Florida Home Loan Qualifier

Find Out How Much Home You Can Afford!

Ready to Buy Your First Florida Home or Next Florida Home?

Florida Home Purchase Loans without the Hassle!

Need financing options on a home, or other real estate? Choosing a purchase loan product that matches your goals and making sure you get a favorable rate doesn’t have to be stressful!

We’re here to make the home loan process easier, with tools and knowledge that will help guide you along the way, starting with a pre-approval letter request.

We’ll help you clearly see differences between loan programs, allowing you to choose the right one for you, whether you’re a first-time homebuyer or a repeat buyer.

The Home Purchase Loan Process

Here’s how our home purchase loan process works:

- Complete our simple mortgage pre-approval letter request

- Receive options based on your unique criteria and scenario

- Compare mortgage interest rates and terms

- Choose the offer that best fits your needs

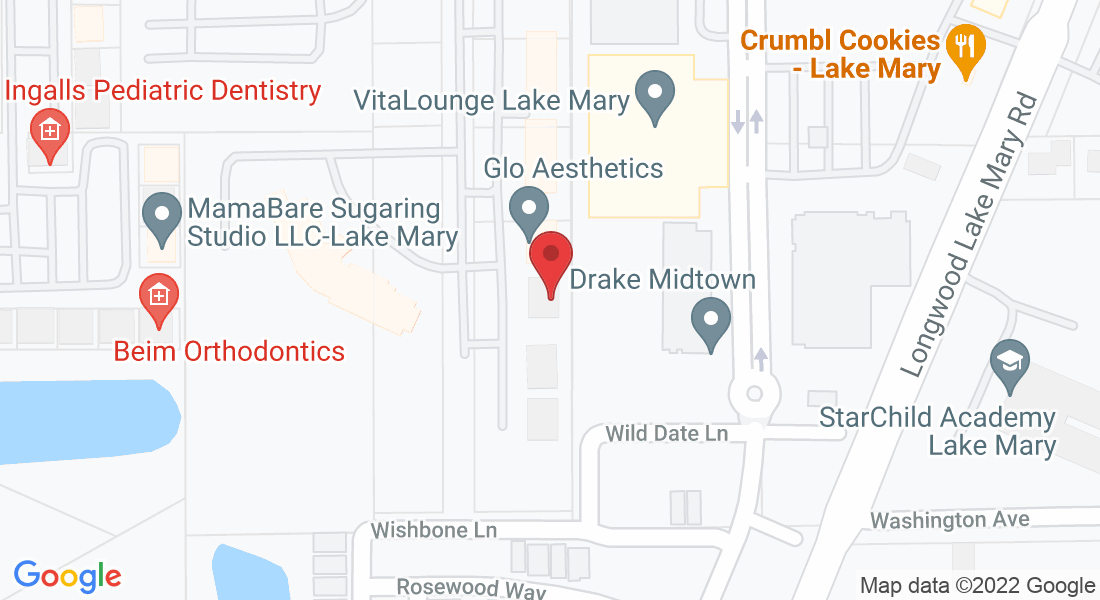

- Orlando

- Lake Mary

- Sanford

- Heathrow

- Altamonte Springs

- Longwood

- Apopka

- Winter Springs

- Winter Garden

- Deltona

Do I Qualify?

To determine if you qualify, lenders review your total monthly debt (proposed housing payment + regular monthly debt) as a percentage of your total gross monthly income. The acceptable percentage (DTI) will vary depending upon the specific loan program for which you apply.

- Fixed-Rate Mortgage

- Adjustable-Rates Mortgage (ARM)

- Conforming Loans

- Jumbo & Super Jumbo Loans

- FHA, VA & USDA Loans

- Terms from 5 to 30 Years

Get Your Pre-Approval Letter Now!

165 Middle St Suite 1101 Lake Mary, FL 32746

(855) 744-EDGE

Copyright ©2021 | Edge Home Finance Corporation

Licensed Home Loans Experts in Florida

BRANCH NMLS #2135961

Edge Home Finance Corp, is an Equal Housing Lender. As prohibited by federal law, we do not engage in business practices that discriminate on the basis of race, color, religion, national origin, sex, marital status, age (provided you have the capacity to enter into a binding contract), because all or part of your income may be derived from any public assistance program, or because you have, in good faith, exercised any right under the Consumer Credit Protection Act. The federal agency that administers our compliance with these federal laws is the Federal Trade Commission, Equal Credit Opportunity, Washington, DC, 20580. Edge Home Finance Corp is a licensed mortgage broker in the following states CA, CO, FL, MN, NC, ND, WI and TX. The following states require disclosure of licensing information. (If your state is not listed, it does not require a specific license disclosure):

CALIFORNIA - Licensed by the Department of Business Oversight under California Finance Lenders Law

COLORADO - Edge Home Finance Corp, 4510 W 77th St #380 Edina, MN 55435,(763) 219-8484; to check the license status of your mortgage broker, visit http://www.dora.state.co.us/real-estate/index.htm

TEXAS - CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A COMPANY OR A RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550.

THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV