30-Year Fixed-Rate Mortgages in Florida are Available!

Receive a quote on a 30-year fixed-rate mortgage in Florida today.

Is a 30-year fixed-rate mortgage right for you?

About 30-Year Fixed-Rate Loans in Florida

The Florida home financing market has seen a major shift in recent years. For those who plan on staying put, the traditional 30-year fixed rate mortgage is an excellent option that offers stability with no surprises or changes throughout your loan period; this type of finance might be best suited if you don't need access to higher interest rates immediately but would rather lock them down at initial signing (and save money along the way)

We're here to make the Florida home loan process easier, with tools and knowledge that will help guide you along your way. The first step is our 30-Year Fixed Rate Mortgage Qualifier!

With our help, you will be able to clearly see the differences between Florida loan programs and choose which one is right for your needs. Whether it's a first-time homebuyer or someone who has bought before but not recently, we can point out what factors are important in each type of purchase so that when all other considerations fail them -- such as price range and credit score requirement--they don't hesitate knowing their decision was sound from start!

The 30-Year Fixed Rate Florida Mortgage Loan Process

Here’s how our home loan process works:

- Complete our simple 30-Year Fixed Rate Mortgage Qualifier

- Receive options based on your unique criteria and scenario

- Compare mortgage interest rates and terms

- Choose the offer that best fits your needs

Do I Qualify?

There are many benefits to taking out a fixed-rate loan, especially when interest rates in Florida fall below those of adjustable mortgages. A good example would be if you plan on staying put for an extended period or want more security with your investment; then the future value may actually end up being lower than what's currently offered by higher risk investments such as index funds that fluctuate based off market conditions like stocks do!

- Florida Fixed-Rate Mortgage

- Adjustable-Rate Mortgage (ARM)

- Conforming Loans Jumbo & Super Jumbo in Florida

- Florida FHA, VA & USDA Loans

- Florida loan terms from 5 to 30 Years

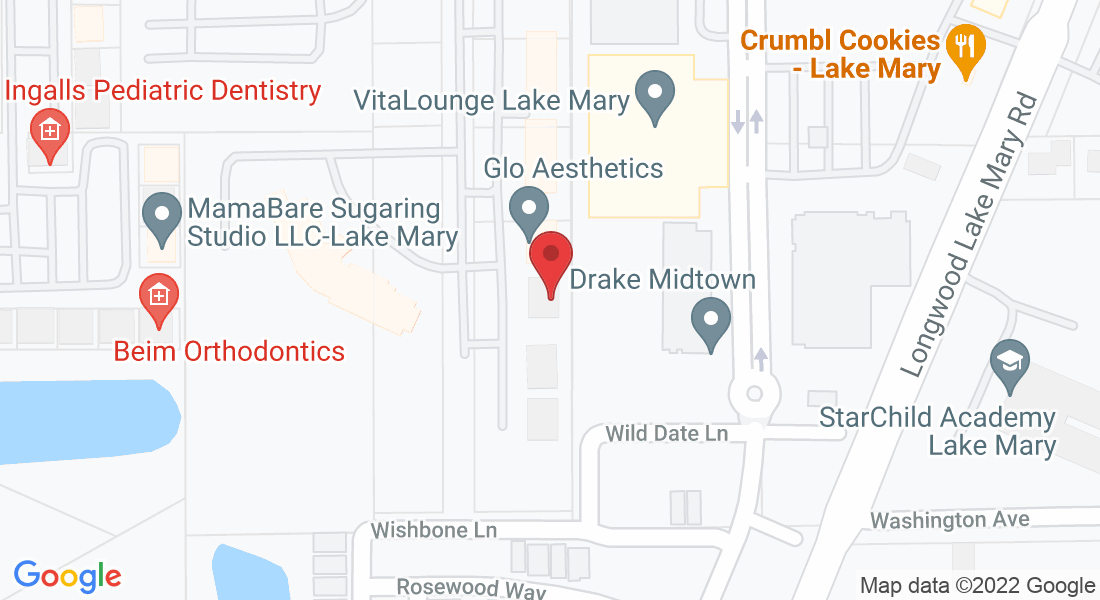

165 Middle St Suite 1101 Lake Mary, FL 32746

(855) 744-EDGE

Copyright ©2021 | Edge Home Finance Corporation

Licensed Home Loans Experts in Florida

BRANCH NMLS #2135961

Edge Home Finance Corp, is an Equal Housing Lender. As prohibited by federal law, we do not engage in business practices that discriminate on the basis of race, color, religion, national origin, sex, marital status, age (provided you have the capacity to enter into a binding contract), because all or part of your income may be derived from any public assistance program, or because you have, in good faith, exercised any right under the Consumer Credit Protection Act. The federal agency that administers our compliance with these federal laws is the Federal Trade Commission, Equal Credit Opportunity, Washington, DC, 20580. Edge Home Finance Corp is a licensed mortgage broker in the following states CA, CO, FL, MN, NC, ND, WI and TX. The following states require disclosure of licensing information. (If your state is not listed, it does not require a specific license disclosure):

CALIFORNIA - Licensed by the Department of Business Oversight under California Finance Lenders Law

COLORADO - Edge Home Finance Corp, 4510 W 77th St #380 Edina, MN 55435,(763) 219-8484; to check the license status of your mortgage broker, visit http://www.dora.state.co.us/real-estate/index.htm

TEXAS - CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A COMPANY OR A RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550.

THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV