Low Rate Florida FHA Home Loans!

Receive a quote on a Florida FHA loan today.

Buy Your Florida Dream Home With Little Money Down With an FHA Loan in Florida!

About Florida FHA Home Loans

The FHA is a federal agency dedicated to insuring loans for housing. With over 6 million homes worth $6 trillion, it's no wonder that this organization has such an important role in our economy! The key difference between an insured loan and one without insurance: if you're planning on buying or refinancing with the government as your partner then they'll cover any losses up until 128% of appraised value (which can go higher depending).

The FHA program was created to help Americans get back on their feet after the rash of foreclosures and defaults that happened in 1930s. It's an insurance plan for lenders, which means they can offer mortgages without worry about themselves getting stuck with repayments if something happens like bankruptcy or death! The housing market also benefits because this makes loans accessible & affordable - meaning more people will be able buy homes than ever before!

Knowledge is power, and we have the knowledge you need to get your Florida FHA home loan approved. As a lender with over 30 years of experience in building mortgage products for our clients across all 50 states-from California to New York -we know what it takes not only be eligible but also choose wisely when applying! So whether this will ultimately become an urban or rural dwelling; purchasing as buyer/renter lacking credit history...the list goes on (and luckily there are plenty more options available than just those two)-our specialists can help guide every step along the way.

We’ll help you clearly see differences between loan programs, allowing you to choose the right one for you whether you’re a first-time home buyer or a repeat buyer.

The Florida FHA Loan Process

Here’s how our home refinance process works:

- Complete our simple FHA Loan Qualifier

- Receive options based on your unique criteria and scenario

- Compare mortgage interest rates and terms

- Choose the offer that best fits your needs

We work for You & Not the Bank. When working with us, your not “stuck” with ONE bank’s restrictive set of underwriting guidelines, which can put caps on your debt to income ratio or require a lot of mortgage reserves! We always seek out the best lender to suit your specific situation and find lenders with the Best FHA Loan Rates!

Get Pre-Qualified Fast, see you’re credit scores immediately, and close in 30 days or less. Get Started Now!

- Complete our simple FHA Loan Qualifier

- Receive options based on your unique criteria and scenario

- Compare mortgage interest rates and terms

- Choose the offer that best fits your needs

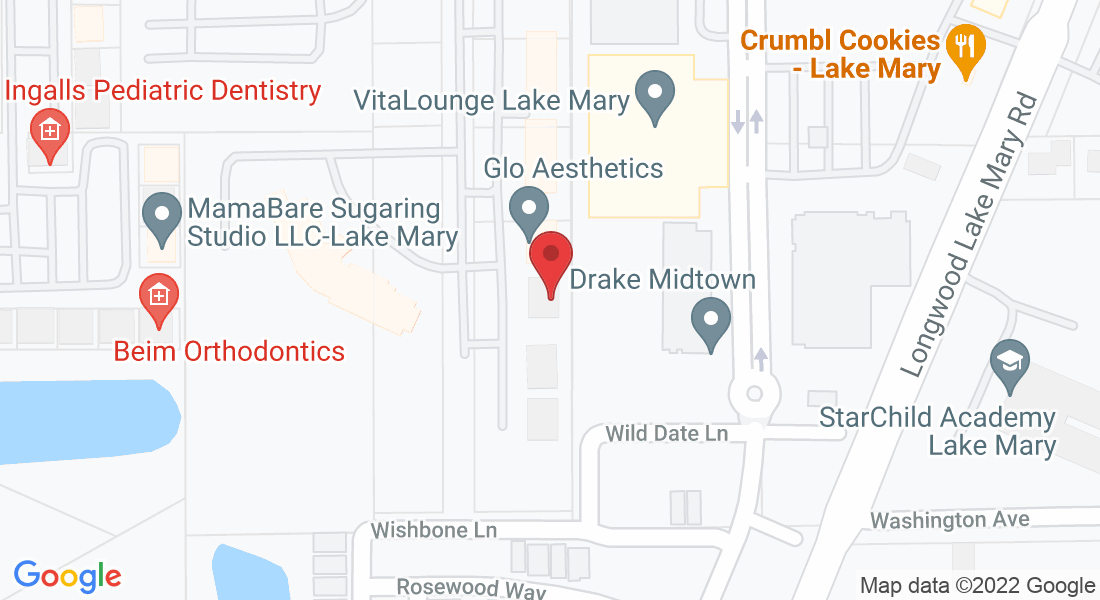

Local Florida we serve:

- Orlando

- Lake Mary

- Sanford

- Heathrow

- Altamonte Springs

- Longwood

- Apopka

- Winter Springs

- Winter Garden

- Deltona

Do you qualify for an FHA Loan in Florida?

The FHA mortgage has many advantages that can make it the perfect loan for refinancing. One such advantage is the low down payment requirement of only 3.5%. This means that you can refinance with an FHA loan even if you don't have a lot of money saved up. In addition, FHA loans come with relaxed qualifying standards, making them ideal for borrowers who don't have perfect credit.

- Fixed-Rate Mortgage

- Low interest rates.

- Relaxed qualifying guidelines.

- Flexible down payment options.

If you're looking for a loan that offers the best of both worlds, an FHA loan may be the perfect choice. With low interest rates, relaxed qualifying guidelines, and flexible down payment options, an FHA loan can make refinancing easy and affordable. Contact a lender today to learn more about how an FHA loan can help you

165 Middle St Suite 1101 Lake Mary, FL 32746

(855) 744-EDGE

Copyright ©2021 | Edge Home Finance Corporation

Licensed Home Loans Experts in Florida

BRANCH NMLS #2135961

Edge Home Finance Corp, is an Equal Housing Lender. As prohibited by federal law, we do not engage in business practices that discriminate on the basis of race, color, religion, national origin, sex, marital status, age (provided you have the capacity to enter into a binding contract), because all or part of your income may be derived from any public assistance program, or because you have, in good faith, exercised any right under the Consumer Credit Protection Act. The federal agency that administers our compliance with these federal laws is the Federal Trade Commission, Equal Credit Opportunity, Washington, DC, 20580. Edge Home Finance Corp is a licensed mortgage broker in the following states CA, CO, FL, MN, NC, ND, WI and TX. The following states require disclosure of licensing information. (If your state is not listed, it does not require a specific license disclosure):

CALIFORNIA - Licensed by the Department of Business Oversight under California Finance Lenders Law

COLORADO - Edge Home Finance Corp, 4510 W 77th St #380 Edina, MN 55435,(763) 219-8484; to check the license status of your mortgage broker, visit http://www.dora.state.co.us/real-estate/index.htm

TEXAS - CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A COMPANY OR A RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550.

THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV